Bank are providing very less interest rate on fixed deposited after Covid-19 , the article Best high-yield savings accounts UK (2024) will provide the details information about most banks.

Introduction

Saving has become a significant role these days after COVID-19 because the research is clearly showing that the country which is having less economy still now they overcome easily from the effects of COVID-19. At the same place, most developed countries like the UK, England, Australia, etc. have good economies still affected more during the COVID period due to a lack of Savings and Investment. Best high-yield savings accounts UK (2024)

In December 2021 bank of England started to decrease interest rates on savings after the inflation. In less than 2 years the interest rate falls more down which was too low for 300 years. Best high-yield savings accounts UK (2024)

First time In history the UK reported that the inflation rate rose more in February 2023 which was almost double of interest rate of the Bank of England’s 2 % target. The CPI rate also increased by 4% at the end of December from 3.9% in November month. Best high-yield savings accounts UK (2024)

Key word:

- Making every dollar of your hard-earned money go a little farther is important when living expenses are rising, having a savings account can be quite helpful.

- There are now several savings accounts in the UK that provide respectable returns on your money.

- From many years most of the banks are offering low interest rates. Due to low interest rate on deposited fund customer are not happy with these rates.

What is a savings account?:

Saving accounts are a type of account in a bank where we can put our money for a short period or long period based on a fixed interest rate. The basic interest rate on savings accounts varies from bank to bank. In India, the basic interest rate varies from 2.70 % to a maximum of 7 %. This interest rate depends upon the type of bank, age of the investor, amount of investor, and locking period. In the US the national average yield for savings accounts is 0.57 percent APY as of 3- Feb. 2024. Sometimes many banks charge multiple services charges, here there are a few lists of charges that apply to most banks. Best high-yield savings accounts UK (2024)

– SMS service fees

– ATM charges

-Early account closure fees

– Overdraft fees

Most of the banks are offering fixed interest rates either quarterly monthly or yearly.

What type of interest do banks give? Best high-yield savings accounts UK (2024)

| Compound Interest | Interest earn to be added at principle amount, usually done on daily or monthly basis |

| Interest | Money earn on having funds in saving accounts. |

| Interest rate | A number which is decided by bank |

| Annual Percentage Yield (APY) | Itis consider from financial year |

| Minimum Balance | if the balance is less than this bank will charge |

| Money Market Account | Types of saving accounts which offers check. ATM |

Type of saving Account:

What are the 3 most common types of savings accounts?

All savings accounts open in any bank will come under three categories.

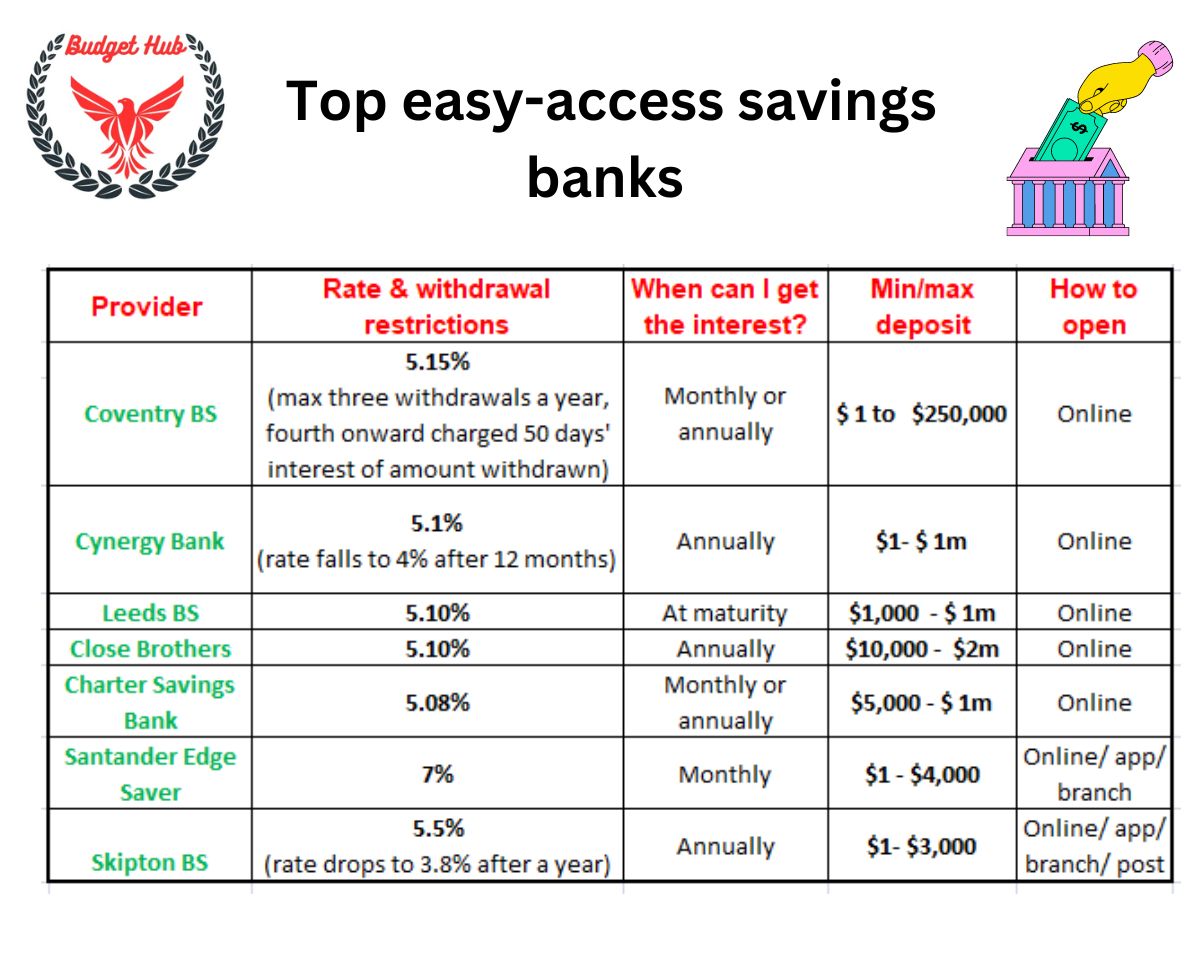

-Easy-access savings account

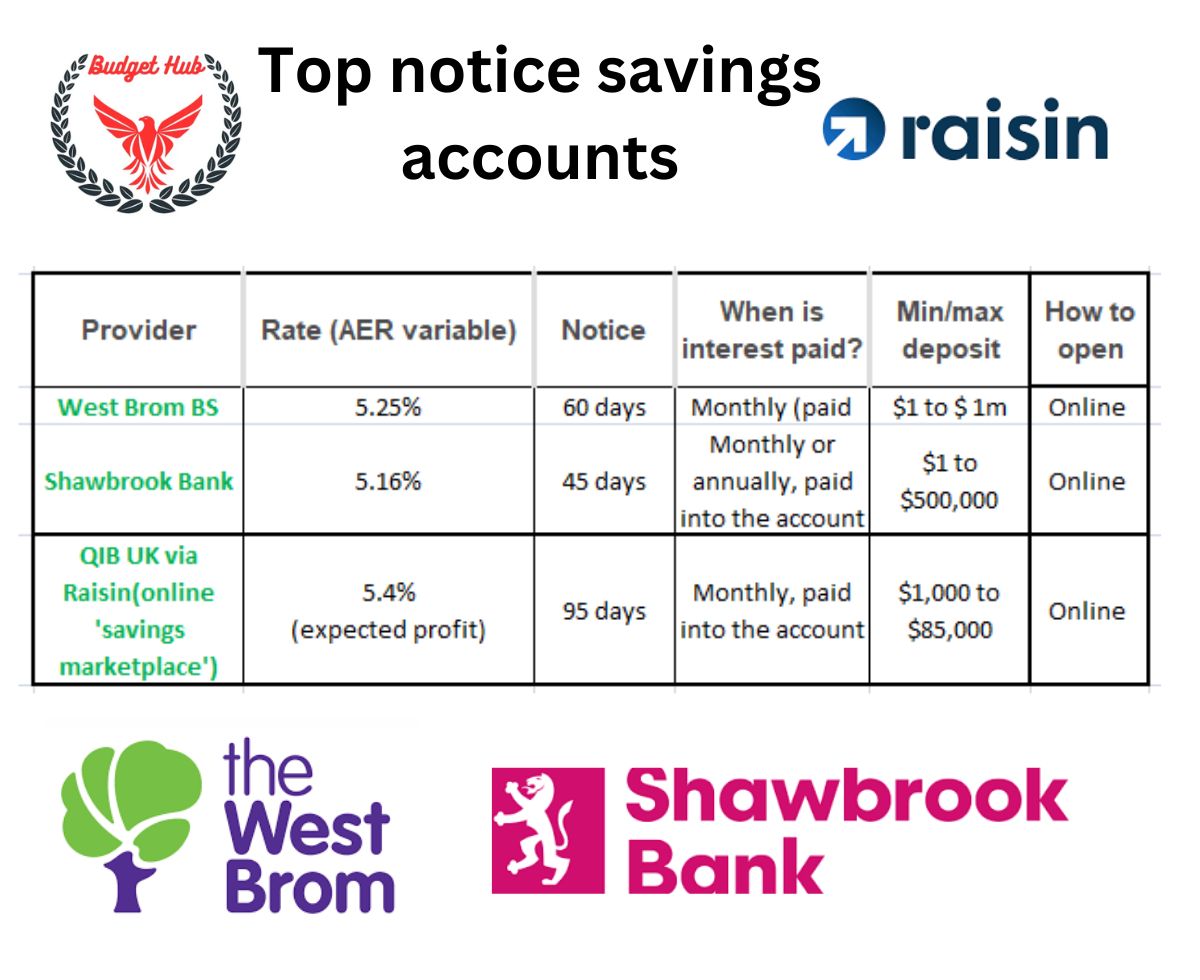

-Notice savings account

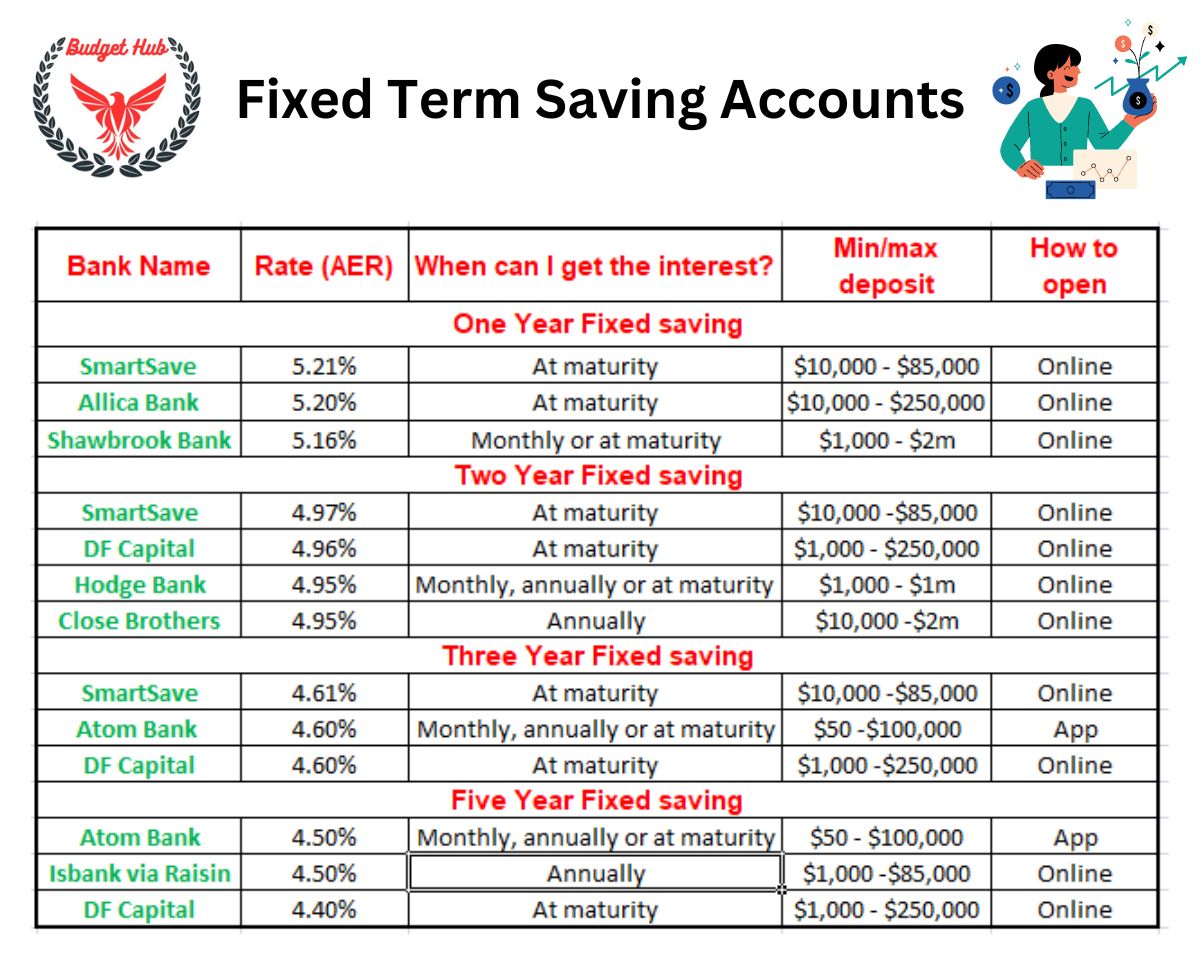

-Fixed Term Saving Accounts

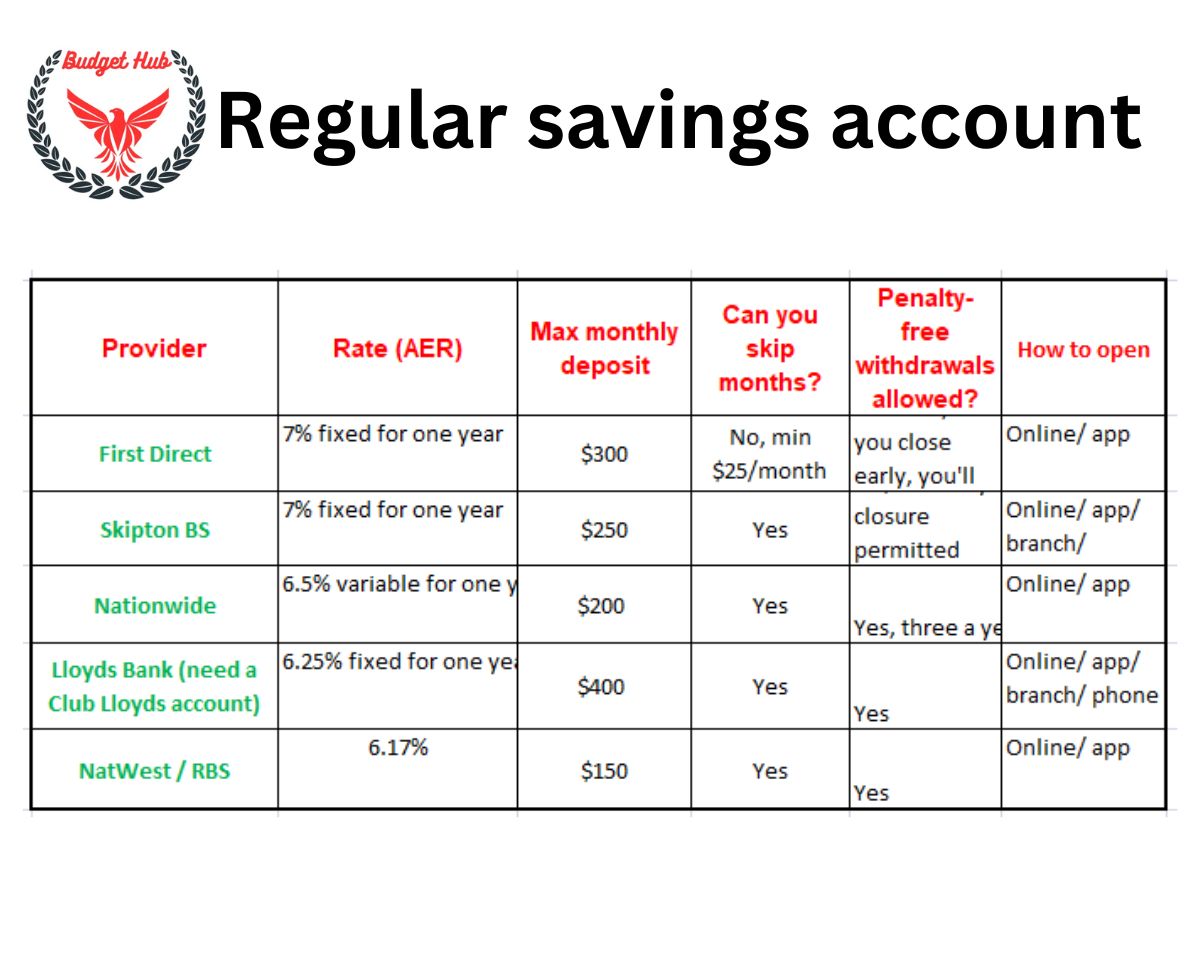

-Regular savings account

Easy-access savings account:

The main aim behind the easy-access savings account is to deposit and withdraw cash from banks without visiting the bank physically and to make customers happy by providing all access and features of the account easily to customers. Most of the banks are offering variable rates of interest on these types of accounts, most of the time it is seen that the interest rate depends upon funds amounts, deposit period, and age of account. Best high-yield savings accounts UK (2024)

Notice savings account:

These types of accounts give pre-information before withdrawing any amounts. In this type of account, money is deposited for some fixed period because depositors are very well known at which period they will withdraw the money from the bank. This type of account will offer more boosted interstate than normal saving accounts. In case of customer wants to withdraw the money from their accounts then they will wait for some period. The interest paid by banks for notice saving accounts depends upon the holding period of money. Best high-yield savings accounts UK (2024)

Fixed Term Saving Accounts:

In this type of account, you cannot withdraw the money before the maturity period, even in the emergency phase if the customer wants to withdraw their saving then banks will charge some amounts. The rate of interest provided by banks is fixed from the initial date of investment. For most of the conditions, it was found that the money would be blocked for a minimum period of 5 years,10 years, and 15 years. Best high-yield savings accounts UK (2024)

Regular savings account:

Normally this type of account is open for regular minimum deposits for long-term return. The minimum return on this type of account varies varying from 5% to 7 % annually. The drawback of these types of accounts is that customers can not withdraw the deposit money at any cost. Normally this type of account is offered by banks, Post offices, and different types of LIC policies. Best high-yield savings accounts UK (2024)

What is High-Yield Savings Account?:

The number of savings accounts has increased in 2023 as per global data.

“The best yield saving account is a type of saving account which gives max return rate in less period with flexible term and conditions.”

High yield saving accounts are the best place to put money for high returns. The budget website from time to time will provide the best high-yield account which gives more returns on saving accounts I hope that this post will help you to find out the best solution. Best high-yield savings accounts UK (2024)

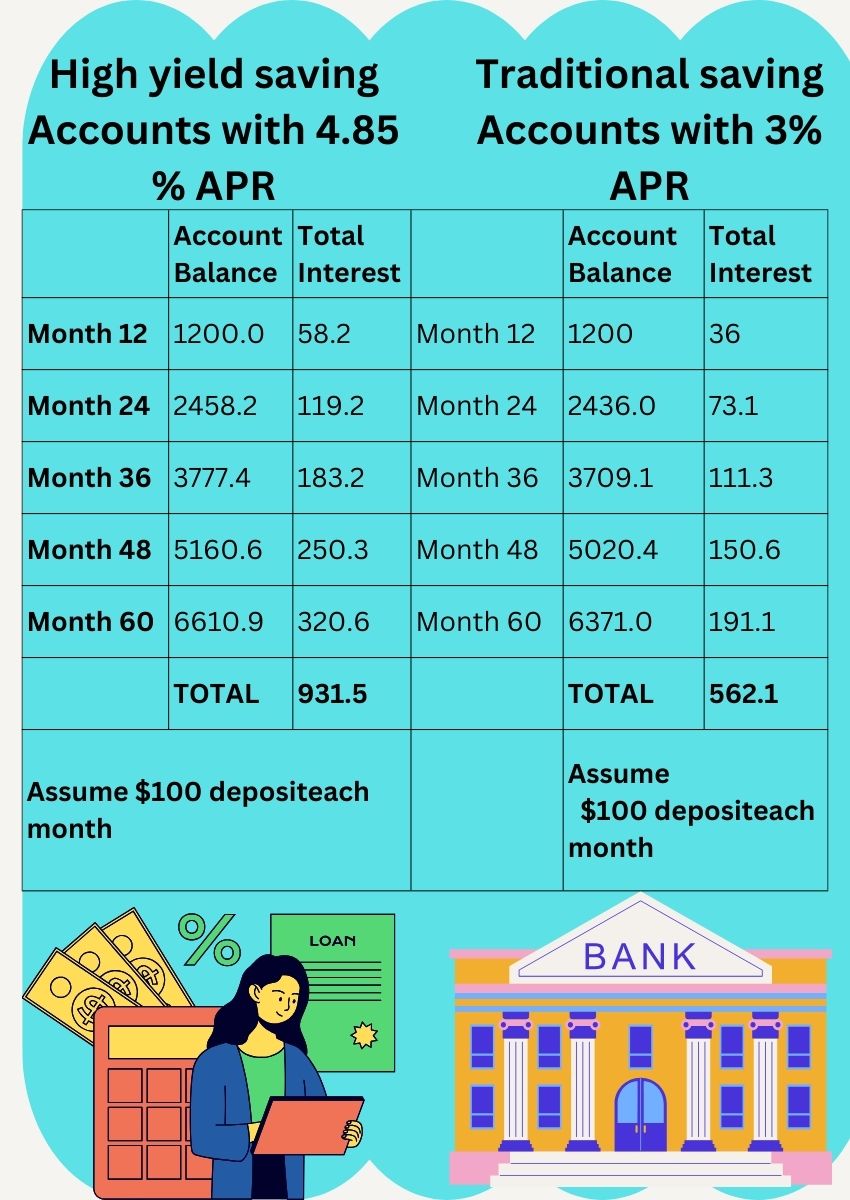

Best high-yield savings accounts Vs Traditional Account:

Best high-yield savings accounts for February 2024:

Most of the high-yield saving accounts have variable APY rates which can change from time to time, but most of the high-yield accounts are giving the higher rate than saving accounts. Whenever customers are looking for high-yield saving accounts the first thing that customers are demand is a deposit certificate and the second thing fixed rate of interest. Most of the savings accounts usually earn compound interest. Best high-yield savings accounts UK (2024)

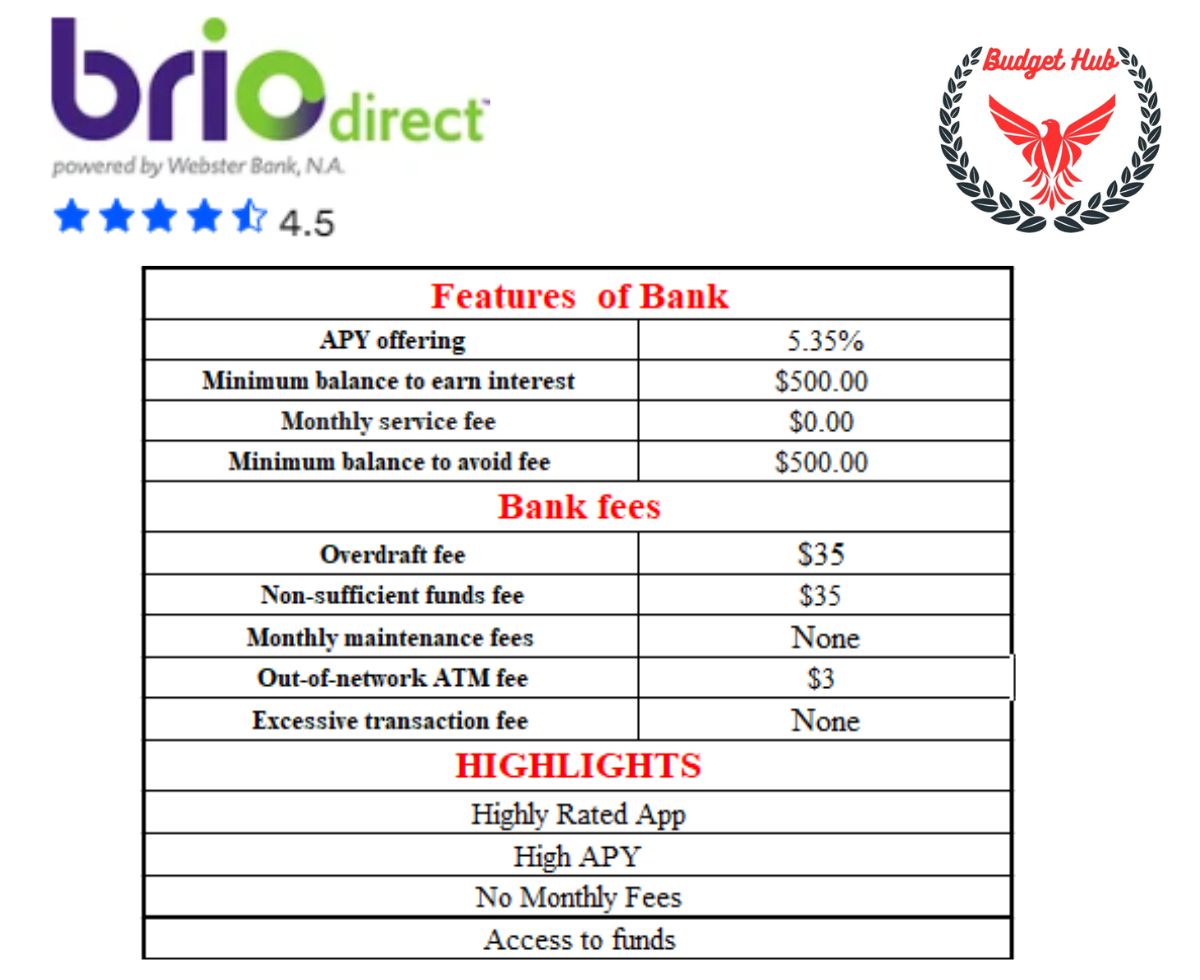

Brio Direct Bank:

Brio Directs is offering the best high-yield saving account with a 5.35% APY rate. The major drawback is that the Brio directs is offering only online bank accounts. The good thing is that banks can’t not charge any monthly fee. A minimum of $5000 is required to open these accounts. To get interest on saving you need to maintain a minimum $500 in account. Best high-yield savings accounts UK (2024)

Customer Support:

The customer support service is available on weekdays day 8 am to 8 pm and Saturdays from 08:30 am 3:00 pm. Mobile banking service is also available for customers to send and receive money. The bank’s app can be used to pay bills, deposit checks, transfer money and view transactions.

Highlights of Brio Direct Bank:

Pros of brio Direct:

- Offers competitive yields on its savings

- Some of the bank CD offers solid APYs for a reasonable minimum deposit amount.

- The account pays a competitive yield

- There’s no monthly service fee.

Cons of brio Direct:

- It provides only online services.

- Do not offer a money market or checking account.

- The $5000 opening deposit requirement is high compared to some banks.

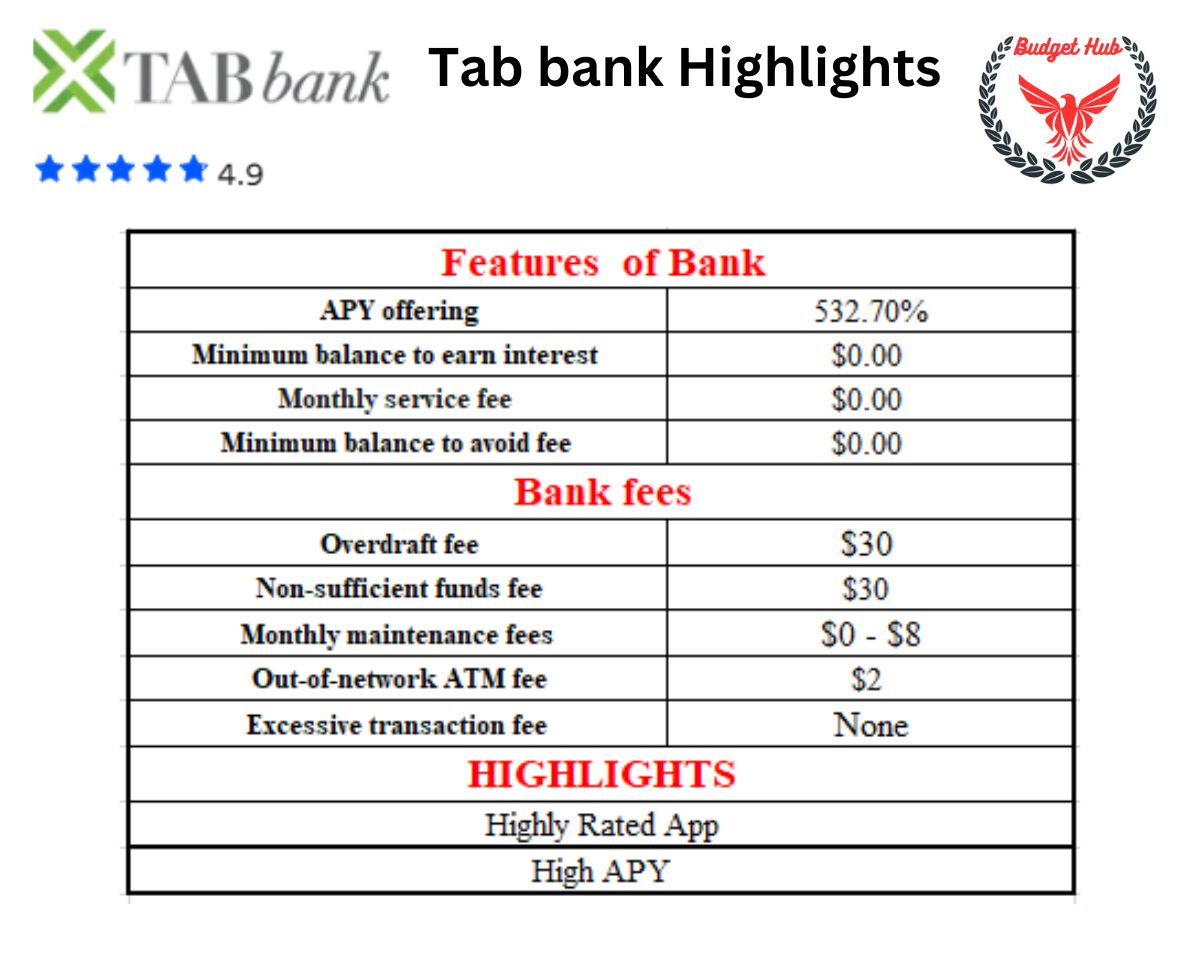

Tab Bank:

Tab Bank is the most famous bank which is known to give a high yield return rate and its unique checking account for truck drivers. The best feature of this bank is bank does not require minimum deposits for opening an account. This bank is also not charging any amount for monthly services. The current APY of Tab bank is 5.27%. Best high-yield savings accounts UK (2024)

Customer Support:

TAB Bank has customer service hours from 6 a.m. to 7 p.m. during the week and Saturday hours are from 9 a.m. to 3 p.m. These hours are not applicable for Federal holidays. The bank is the most famous bank that offers the best online and mobile banking services. The app tab bank allows users to deposit money, pay bills, send money to friends or family, and get account alerts.

Highlights of Tab Bank:

Pros of Tab Bank:

- Deposit accounts pay higher yields than many other banks.

- Its mobile app is highly rated on iOS and Android.

- Minimum deposit requirements are low.

- The account pays a competitive APY

Cons of Tab Bank:

- TAB has only one physical location.

- other online-only banks pay higher yields on deposits.

- They charge paper statements cost $5 .

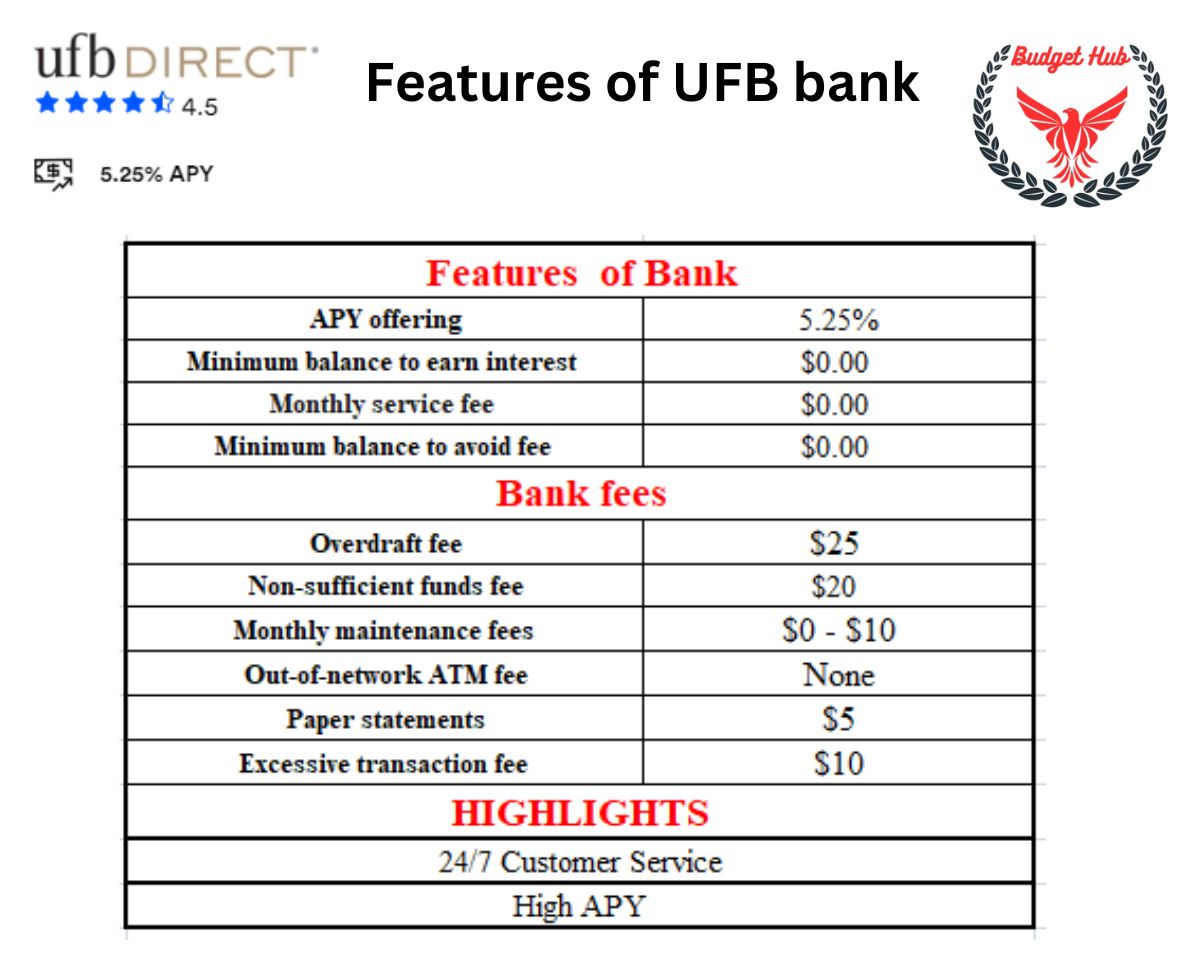

UFB Direct Bank:

The UFB bank mostly offers money market accounts and high-yield accounts. The UFB savings accounts offer ATM services without any monthly charge. The Current APY of UFB Direct Bank is 5.25% but at the same time, this bank is charged $8 monthly for the money market. The major drawback of this is that it offers only two types of account services. Best high-yield savings accounts UK (2024)

Customer Support:

The well good thing is that this bank offers 24/7 days customer service except that holidays. The customer can call to services center from 8 am to 5 pm other than these facilities customers can get the solution to their problems with the help of chat boot.

Highlights of UFB Bank:

Pros of UFB Bank:

- Both types of accounts earn highly competitive yields.

- A money market account offers check-writing privileges.

- Easily access SMS banking and a well-rated mobile app.

- ATM card that can be used for free cash withdrawals at over 90,000 ATMs.

- Unlimited transfer on saving

- No monthly maintenance fee.

Cons of UFB Bank:

- There is a $10 monthly fee on the money market account unless you keep at least $5,000 in the account.

- UFB Direct frequently relaunches its savings and money market accounts.

- There is a $5 fee for receiving paper account statements.

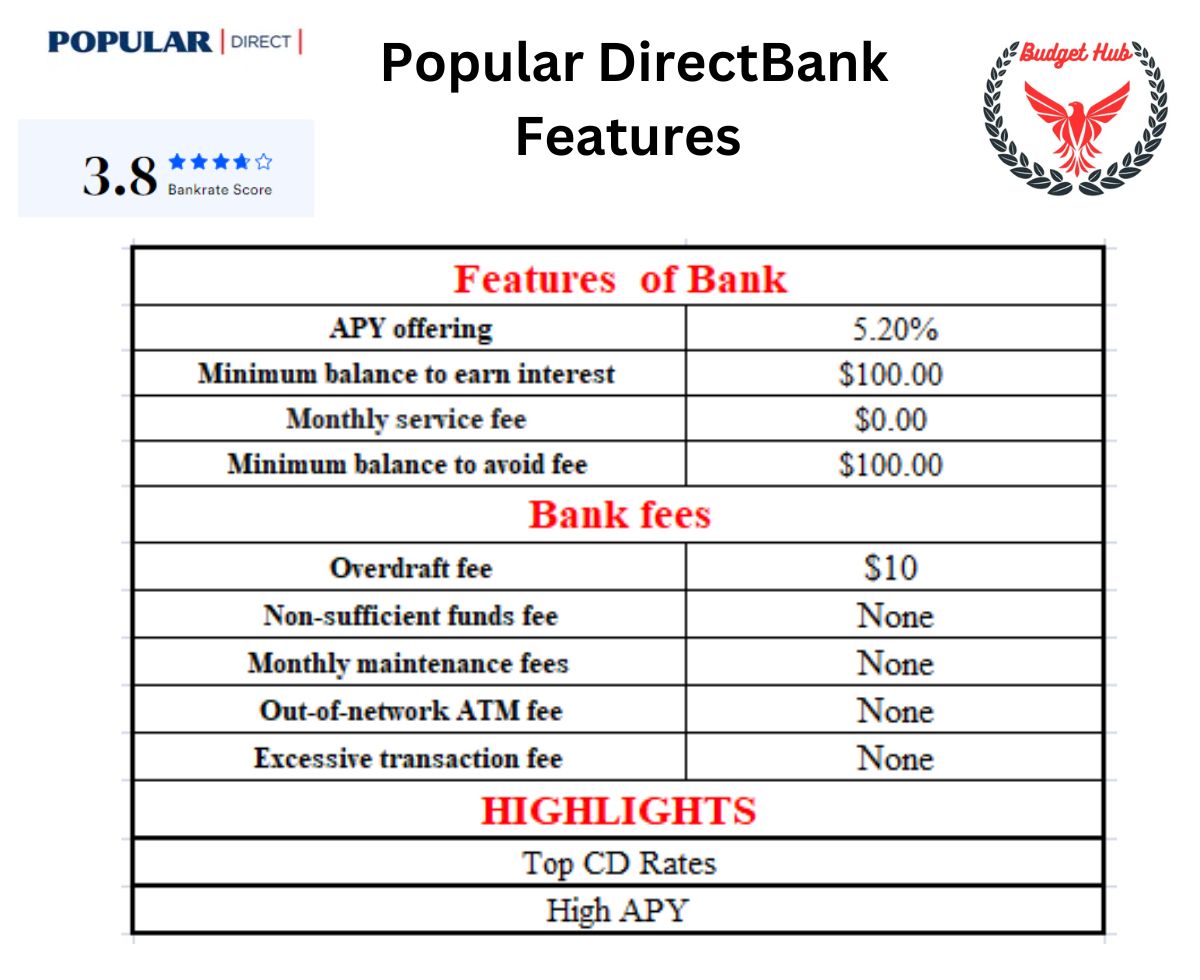

Popular Direct Bank:

This bank is offering the most popular yield bank account. This bank requires a minimum deposit of $100 to open an account. If any customer wants to close any account within 180 days then the bank will charge a minimum of $25. From 2016 onward the bank started to work in the market and grow within less time. This bank offers online services but till now there have been no ATM services started. Due to the lack of features, the customer rating is very low for the APP. Best high-yield savings accounts UK (2024) Best high-yield savings accounts UK (2024)

Customer Support:

Customer service can be reached over the phone between 7:30 a.m. and midnight ET Monday through Friday, and between 9 a.m. and 6 p.m. on weekends.

Highlights of Popular Direct Bank :

Pros of Popular Direct Bank:

- It offers a highly competitive rate

- Relative to other banks charge is less

- No monthly service charges.

- The minimum deposit is much lower than others.

Cons of Popular Direct Bank:

- There is no ATM access.

- The mobile app has limited features.

- It will not offer checking and money market accounts.

- No ATM card is provided for any type of account.

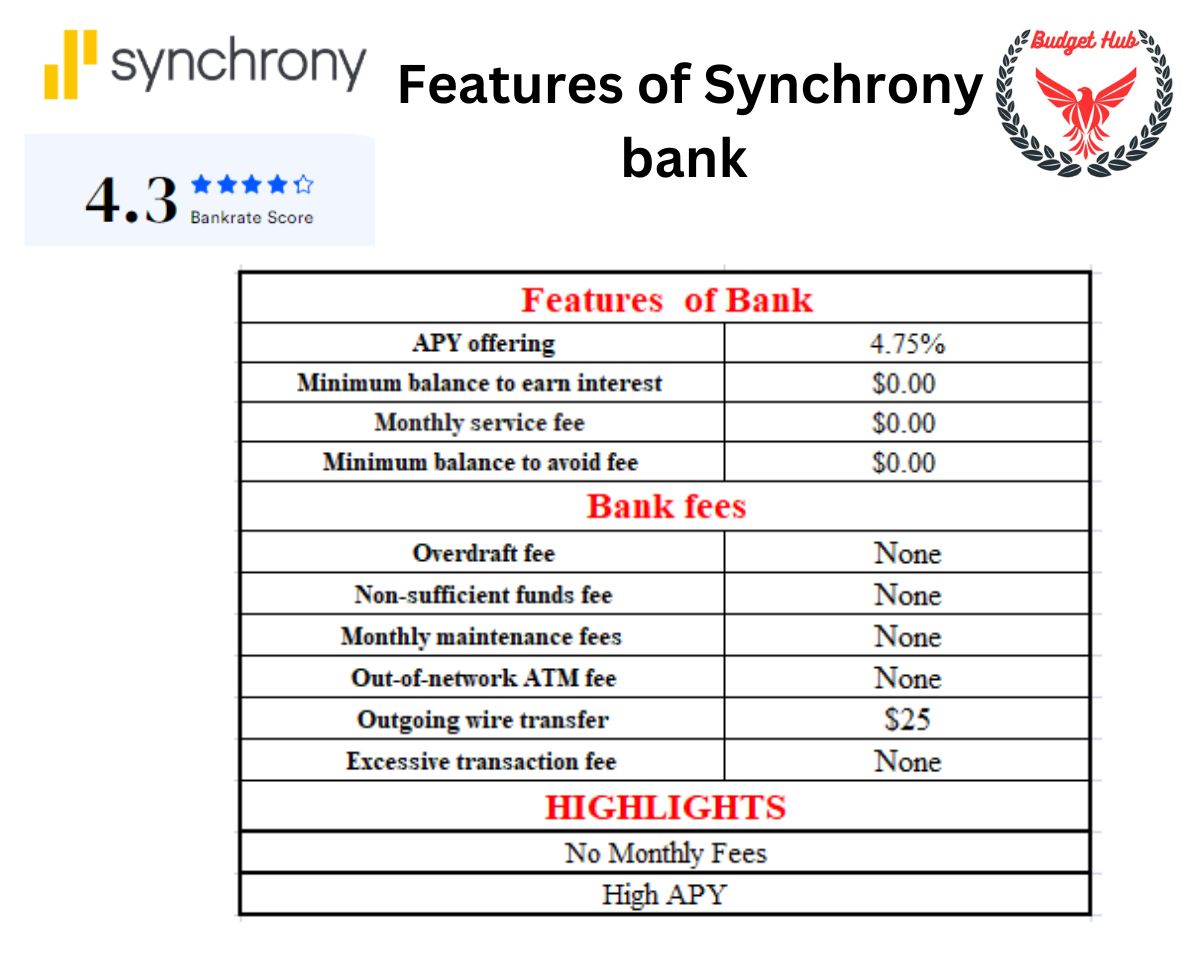

Synchrony Bank:

Synchrony Bank offers high-yield accounts with the highest ATM service access. The bank also reimburses up to $5 per month in domestic ATM fees, which will help the occasional ATM user. These banks did not require any initial deposit to open a bank. There is no charge on the minimum balance in the account.

Customer Support:

This bank offers only online banking because it does not have any physical branch, the bank offers customer support for all seven days from 8 am to 10 pm, and for Saturday it offers 8 am to 5 pm only with app features.

Highlights of Synchrony Bank:

Pros of Synchrony Bank:

- Offers a competitive yield

- There are no monthly service fees.

- The account comes with an ATM card

- It offers up to $5 in domestic ATM rebate

Cons of Synchrony Bank:

- This bank has no branches.

- This will not offer Checking accounts

- It does not give a higher yield on money market accounts

- The bank offers the same APY in all tire cities.

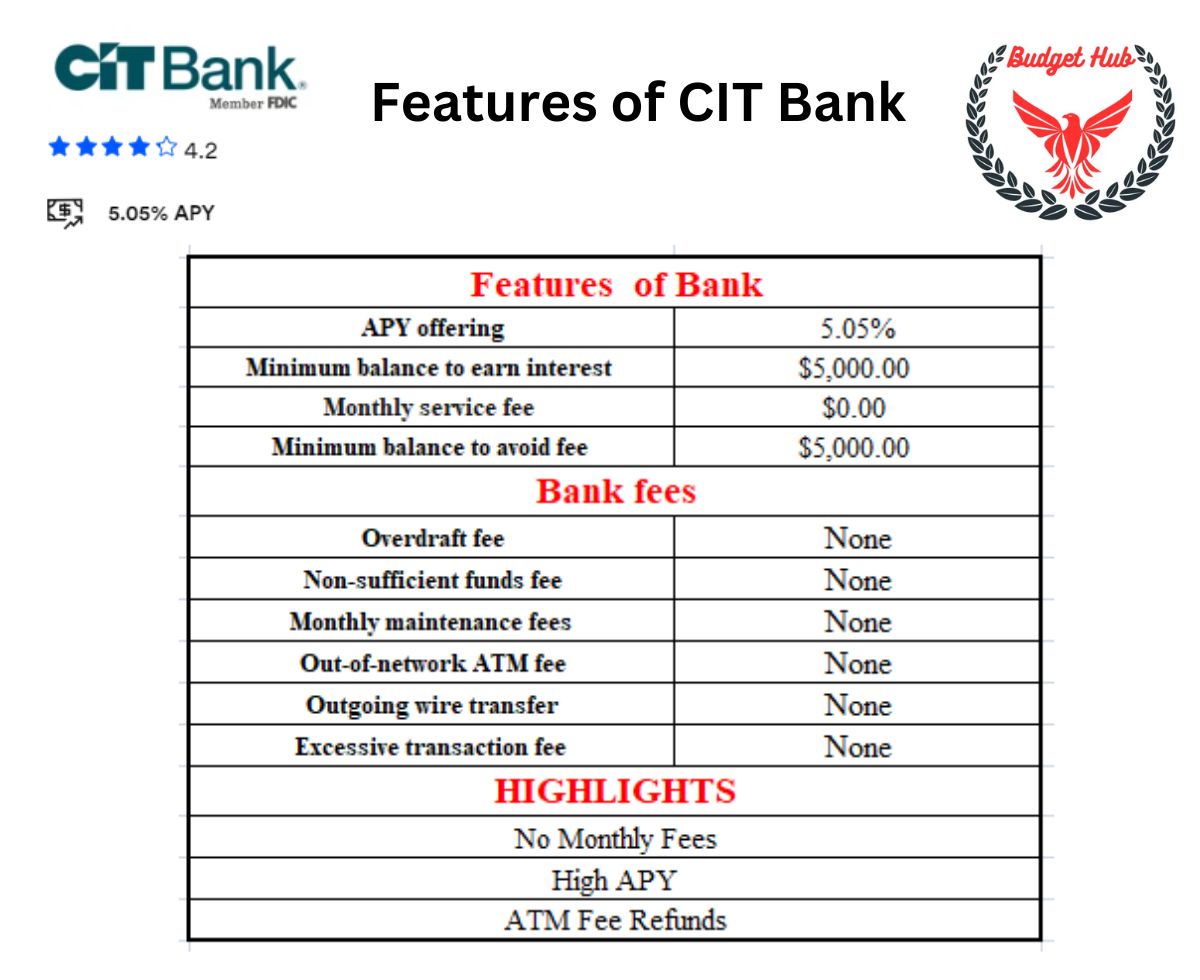

CIT Bank:

This bank is very famous for offering the best high-yield account with an initial bank opening charge of $100. This bank offers money market accounts saving accounts and CDs. The Current APY is 5.05 %. This bank offers refundable ATM charges.

Customer Support:

This bank offers mobile banking and app features that will allow transferring funds from one account to another account within CIT Bank.

Highlights of Synchrony Bank:

Pros of CIT Bank:

- There are no monthly fees for any accounts

- The checking account earns interest.

- Customers get up to $30 in ATM surcharges

Cons of CIT Bank:

- Some of the APYs for CDs fall below the national average for their respective terms.

- The bank doesn’t have physical branch locations.

- Minimum opening deposit of $100

What is drawback of high yield saving Account? :

– Rate is not fixed for all high yields saving accounts it can vary from time to time.

– Some banks restrict withdrawals/transfers to only six a month.

– Checks generally can’t be written using savings accounts.

– Not all online banks offer branch or ATM access.

How to open a high-yield savings account:

Before opening high yield savings account first you need to analyze the financial need, target, and account types, we should consider the following parameter Best high-yield savings accounts UK (2024)

– Earn highly competitive APY

– Should have a minimum opening charge

– Accounts should not have any monthly charges

– Account should be easily accessible

– Account should be controlled in an online mode

– Best customer service

The following steps to followed

Shop nearby:

Most of the high-yield accounts are operating in online mode and it is offered in shopping malls, restaurants, etc based on bank credit. Best high-yield savings accounts UK (2024)

Fill the Application:

Once you have decided to open a high-yield savings account you need to fill application form whether in online mode or offline mode. The following document is required . Best high-yield savings accounts UK (2024)

– Driver’s license number

– Social Security number

– Mailing address

– Date of birth

– Government Issue Photo ID

Fund your account:

After submitting of application you need to wait until it gets approved after getting the account activated you need to deposit funds in the account either online mode or offline. For automatic funding, you can link your savings accounts to high-yield savings accounts. Depending on the bank, you might be able to fund the new savings account through a wire transfer or by mailing a check.

High-yield savings terms to know everyone:

There are a few important things that every investor knows before investing either offline or online. Every customer needs to know which type of high-yield account is the best for his /her planned target.

Which bank gives 7% interest on savings account UK?

The first direct bank is giving the double interest rate on market regular savings accounts. In the last 3-4 years the interest rate has jumped from 3.5 % to lump-sum 7 %. To get a better high yield from accounts you need to deposit a minimum of $25 to $300 each month. To get a higher yield you need to maintain a minimum deposit balance as per bank norms. Best high-yield savings accounts UK (2024)

Where can I get 5% interest on my savings UK?

– Brio direct bank

– Tab bank

– UFB bank

– Popular Direct Bank

– CIT bank

Can you get 7% interest savings account?

As of February 2024, there is no bank offering 7% interest on any type of savings account that banks are offering. Best high-yield savings accounts UK (2024)

How much interest will $50000 earn in a savings account?

A sum of $50,000 in cash can earn about $195 a year in an average bank savings account or as much as $2,300 if you put it into a high-quality corporate bond fund.

Best high-yield savings accounts UK (2024)

How to double $50000 quickly?

Real Estate Investing

Passive Income Generation

Mutual Funds Investments

Best high-yield savings accounts UK (2024)

Can you ever lose your money with high yield savings account?

It is difficult to tell you that you can lose your money but it can be possible when you share your online logging ID, password, mobile app, etc. Best high-yield savings accounts UK (2024)

Is it better to have a High Yield Savings Account or a CD?

In a high-yield savings account, we need to deposit a fixed amount of $25 – $500 per month for getting regular interstate. If we fail to deposit the minimum amount in the account then the bank will charge some money. Best high-yield savings accounts UK (2024)

In the case of CD whenever any customer deposits some amount the bank will issue a deposit certificate. Deposit certificate customer can show this certificate to the bank and claim for his money.

This CD is the best option

Best high-yield savings accounts UK (2024)

Are high yield savings accounts taxed?

NO Best high-yield savings accounts UK (2024)

Final Word:

The growth of money is depends upon the many factor like market value, investment types, investment period etc. Most of the time it was found that roughly required 9-10 years to became double of any income but in case of stock market it is not applicable . Best high-yield savings accounts UK (2024)

Wow amazing blog layout How long have you been blogging for you made blogging look easy The overall look of your web site is magnificent as well as the content

thanks

This gateway is fabulous. The splendid substance displays the publisher’s commitment. I’m overwhelmed and envision more such astonishing material.

i will do more

I loved as much as youll receive carried out right here The sketch is tasteful your authored material stylish nonetheless you command get bought an nervousness over that you wish be delivering the following unwell unquestionably come more formerly again since exactly the same nearly a lot often inside case you shield this hike

hearold mincks

Thanks for sharing. I read many of your blog posts, cool, your blog is very good.

kaeisha honl

faraj patete

maiki lonna

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

Can you be more specific about the content of your article? After reading it, I still have some doubts. Hope you can help me.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

I don’t think the title of your article matches the content lol. Just kidding, mainly because I had some doubts after reading the article.

I really enjoyed what you have accomplished here. The outline is elegant, your written content is stylish, yet you seem to have acquired a bit of apprehension over what you aim to convey next. Undoubtedly, I will revisit more frequently, just as I have been doing nearly all the time in case you sustain this upswing.

I genuinely appreciated what you’ve achieved here. The outline is tasteful, your written content fashionable, yet you appear to have acquired some uneasiness regarding what you wish to present forthwith. Undoubtedly, I’ll return more frequently, similar to I have almost constantly, should you sustain this upswing.

Stumbling upon this website was such a delightful find. The layout is clean and inviting, making it a pleasure to explore the terrific content. I’m incredibly impressed by the level of effort and passion that clearly goes into maintaining such a valuable online space.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.

Your point of view caught my eye and was very interesting. Thanks. I have a question for you.